Let's be real for a moment. What exactly is invoice payment processing? At its heart, it’s the entire journey an invoice takes through your business—from the moment it lands on your desk (or in your inbox) to the second the payment leaves your account.

Getting this process right is absolutely fundamental. A smooth, efficient workflow is the bedrock of healthy cash flow, solid supplier relationships, and financial records you can actually trust.

Are You Buried in Manual Invoice Work?

We've all been there—late nights drowning in a sea of paper, painstakingly keying invoice data into a spreadsheet. This administrative grind isn't just a headache; it’s a silent killer of productivity and a major roadblock to your company's growth.

Think about the classic scenario: you're hunting down a missing invoice for a critical supplier, only to find out their payment is held up because of a simple typo made weeks ago. These aren't just minor annoyances. They are moments of friction that erode trust, damage partnerships, and stall your momentum.

The True Price of Old-School Methods

The cost of sticking with outdated, manual processes is so much more than just wasted hours. It’s a ripple effect of inefficiency that touches every corner of your business.

Let’s break down what you're really paying for:

- Damaged Supplier Relationships: Nothing sours a great partnership faster than late or incorrect payments. A reliable supplier might start giving you less favorable terms—or worse, prioritize a competitor—if they can't count on you to pay them on time.

- Forfeiting Free Money: So many suppliers offer a 1-2% discount for paying an invoice within 10 days. When your process is bogged down by manual steps, you're literally leaving money on the table every single month.

- The Inevitability of Human Error: Manual data entry is a breeding ground for mistakes. Transposed numbers, wrong amounts, even duplicate payments. Every error is another fire to put out, another delay in the cycle.

It might surprise you to learn just how common this is. Even in 2025, a staggering 68% of companies worldwide are still manually typing in their invoice data. With the average cost to process a single invoice manually sitting at around $15, and with nearly 39% of those invoices containing errors, the financial drain is enormous. You can see more of these eye-opening accounts payable stats over at Docuclipper.

The game changes the moment you stop seeing invoice processing as a mundane chore and start treating it as a strategic lever for financial strength and business agility. Automation isn't just a time-saver; it's a focus-reclaimer.

Picturing a Better Way with Automation

This is where you flip the script. Automation frees your team from the soul-crushing administrative tasks and empowers them to focus on what actually moves the needle—analyzing financial trends, strategizing for growth, and building a more resilient company.

An automated system does so much more than just pay the bills. It gives you clarity, control, and the confidence to make smarter decisions. If you're ready to really speed up your own cash flow, our guide on how to get invoices paid faster is the perfect next step.

Seeing this vision clearly is the first move toward transforming your financial operations from a necessary expense into a powerful engine for your success.

Building a Payment Workflow That Actually Works

Creating a truly efficient invoice payment process is less about following a rigid checklist and more about designing a smooth, intelligent system that fits your business perfectly. Think of it as a journey that starts the second an invoice lands on your desk (or in your inbox) and doesn't end until the payment is reconciled and everyone is happy.

Let's walk through what that journey looks like.

It all starts with getting the invoices into one place. They come from everywhere, don't they? Email attachments, supplier portals, maybe even the occasional piece of snail mail. The first big win is to stop chasing them down and funnel everything into a single, centralized hub. This is where a little tech magic called Optical Character Recognition (OCR) comes into play.

OCR isn't just a fancy scanner. It intelligently reads the document, pulling out the crucial bits of information—invoice numbers, due dates, amounts, line items. This instantly turns a pile of static PDFs into live, usable data. More importantly, it saves your team from the mind-numbing task of manual data entry and slashes the risk of typos and errors.

Designing Smart Approval Chains

Once an invoice is in the system, it needs a green light. But a single approval queue for every bill is a surefire way to create bottlenecks and frustrate everyone. The key is to build smart, flexible approval routes that match the invoice itself.

A recurring $100 bill for office supplies shouldn't have to wait for the CFO. You can set up rules that automatically approve these small, predictable expenses from vendors you already trust. On the other hand, a large invoice over, say, $5,000 should absolutely trigger a more robust approval process involving department heads or senior leaders.

Here’s how you could structure it:

- Tier 1 (Under $500): These can be auto-approved, especially if they are recurring bills from known suppliers (like your internet service).

- Tier 2 ($501 – $2,500): This might require a quick sign-off from the manager who requested the purchase.

- Tier 3 (Over $2,500): This tier could demand approval from both the department head and someone in finance.

This kind of logic makes sure the right eyes are on the right invoices, keeping the small stuff moving and giving proper attention to the big-ticket items.

Connecting the Dots for Final Payment

The last piece of the puzzle is making sure your new workflow talks to your accounting software. Whether you use QuickBooks, Xero, or a larger ERP, this connection has to be seamless. It’s not optional.

A truly automated workflow doesn’t just stop when an invoice is approved. It’s only finished when the payment is sent, the transaction is logged in your books, and the invoice is officially closed out—all without a single manual click.

This tight integration keeps your financial records accurate and gives you a crystal-clear, real-time picture of your cash flow. Once an invoice is coded and approved, the system should line it up for payment, helping you hit those early payment discount windows without even thinking about it.

Finally, the system triggers the payment and sends a clear payment confirmation to the supplier. This simple step closes the loop and is huge for maintaining great vendor relationships. To learn more about getting this right, check out our guide on what a payment confirmation should include.

Ultimately, a well-built workflow isn't just about paying bills faster. It’s about creating a strong, scalable financial engine for your entire business.

Selecting Your Invoice Processing Tech Stack

Diving into the world of payment solutions can feel like a lot, but picking the right technology is one of the most empowering things you can do for your business. The real goal isn't just to find a tool. It's to build a tech stack that works for you—one that feels like a natural part of your workflow, supports your vision, and grows right alongside you.

Your journey begins with a clear view of the landscape. On one side, you have straightforward invoicing apps, perfect for freelancers or small businesses getting their feet wet. On the other, there are comprehensive accounts payable (AP) automation platforms built to handle the complex, high-volume demands of a larger operation. Your sweet spot is somewhere in between, and it's defined entirely by what you need.

Defining Your Must-Have Features

Before you even book a demo, take a few minutes to map out your non-negotiables. This isn’t about chasing the platform with the longest feature list; it’s about finding the one with the right features. Think about your daily grind. Where are the bottlenecks? What's causing the headaches?

Your checklist should get down to the brass tacks:

- Diverse Payment Options: Can the system easily manage ACH transfers, virtual cards, and international wires? The more flexibility you have in how you pay, the better your relationships with suppliers will be.

- Multi-Currency Support: If you're working with vendors across the globe, this is an absolute must. A system that can handle currency conversion and navigate cross-border compliance on its own is a massive time-saver and risk-reducer.

- Rock-Solid Security: Go beyond the basics. You need to see things like multi-factor authentication (MFA) for approving payments and full PCI-DSS compliance. These aren't just buzzwords; they're critical safeguards for your company's finances.

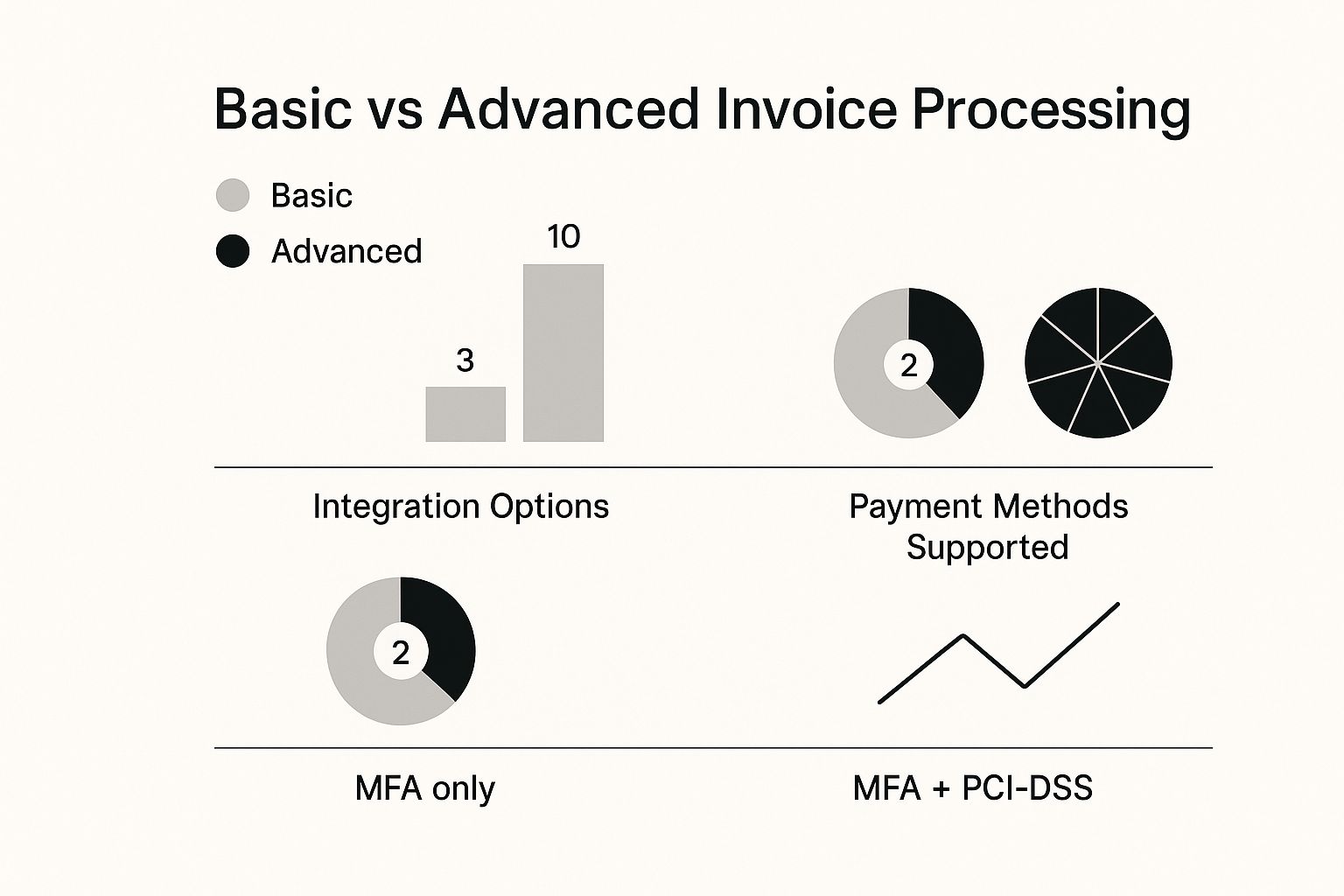

This infographic really highlights the difference between what a basic tool can do versus a more advanced one.

As you can see, the advanced solutions bring so much more to the table—more integrations, greater payment flexibility, and tougher security. For any business with plans to scale, these are vital.

Choosing the right tool is a big decision, so it helps to see how the options stack up. Here's a quick comparison to help you understand the key differences between the most common types of invoice processing solutions.

Feature Comparison of Invoice Processing Solutions

| Feature | Basic Invoicing Software | AP Automation Platform | Global Payment Processor |

|---|---|---|---|

| Invoice Creation | Yes, core feature | Often included | Not typically a focus |

| Payment Options | Limited (e.g., credit card, bank transfer) | Extensive (ACH, V-card, check, international) | Extensive, especially for cross-border |

| Workflow Automation | Minimal to none | Core feature (approvals, routing) | Focused on payment execution |

| Accounting Sync | Basic (e.g., QuickBooks, Xero) | Deep, two-way sync with ERPs | Can integrate, but often less deep |

| Fraud Detection | Basic security measures | Advanced AI-driven checks | Robust, core to their business |

| Global Capabilities | Limited or non-existent | Strong, with currency management | Specialized and comprehensive |

| Best For | Freelancers, very small businesses | Growing SMBs and enterprises | Businesses with heavy international trade |

This table should give you a starting point. Your ideal solution might even be a combination of these, depending on your specific operational needs.

Asking Vendors the Right Questions

Once you’ve narrowed down your list of potential partners, it’s time to start asking the tough questions. This is your chance to get past the slick marketing slides and really understand how a platform will function in your day-to-day reality.

Don't be shy. Get specific with questions like:

- "How does your platform integrate with my current accounting software?" You're looking for a truly seamless sync that eliminates the need for manual data entry and reconciliation.

- "Can you walk me through your security and fraud detection measures?" Ask them to get into the details of how they protect your data and flag suspicious activity before a payment goes out.

- "What does your onboarding and support process look like?" The most powerful technology in the world is useless if you don't have a great team helping you make the most of it.

This proactive approach is backed by what we're seeing across the industry. An incredible 72% of small businesses now see payment processors as essential for managing their finances. On top of that, modern tools that use AI for automation and fraud detection can cut processing costs by up to 30%, delivering a major boost to both speed and security. You can dig deeper into these payment processing statistics to see just how much technology is changing the game.

Choosing your tech stack is more than a technical decision; it's a commitment to your company's future. Select a partner whose technology not only solves today's problems but also has the vision and capability to support your growth tomorrow.

Embracing Modern and Global Payment Methods

Let's be honest, the way we pay our bills has changed dramatically, and your business can't afford to be left behind. Keeping up with how your partners and suppliers want to get paid isn't just a nice-to-have anymore; it's a massive strategic advantage. When you offer a wide range of payment options, you send a clear signal: you're a modern, flexible, and serious player in the global market.

This flexibility in how you handle invoice payments goes so much deeper than just accommodating a preference. It's really about forging stronger, more resilient relationships. Imagine being able to pay a key international supplier in their local currency without any friction. Or settling a big invoice with a highly secure virtual card. When you do that, you're not just moving money—you're removing barriers and building a foundation of trust.

Expanding Your Payment Toolkit

For decades, we’ve relied on the old workhorses: bank transfers and paper checks. But they’re slow, often lack transparency, and just don't cut it in today's fast-paced world. Thankfully, we have much better tools now designed to fix those exact problems.

Here are a few essentials you should absolutely have in your payment arsenal:

- ACH Payments: Think of these as the modern, cost-effective way to handle domestic bank-to-bank transfers. They’re reliable and clear much, much faster than waiting for a check to land.

- Virtual Cards: These are a game-changer for security. They're single-use, digital cards that mask your actual account details. You can even set specific spending limits, giving you an incredible amount of control over every transaction.

- Wire Transfers: When you're dealing with large sums or paying international suppliers, wires are still the gold standard. They offer a direct, secure path for sending funds across borders, making sure your global partners get paid on time, every time.

When you diversify how you pay, you’re doing more than just speeding things up. You're actively making your supply chain stronger. A supplier who trusts they'll be paid quickly and easily is a supplier you can count on for the long haul.

The Next Wave of B2B Payments

And the innovation isn't stopping there. We're seeing some really exciting new trends that are completely reshaping B2B transactions. One of the biggest shifts? The rise of Buy Now, Pay Later (BNPL) options, which have officially jumped from consumer shopping carts into the B2B invoicing world.

Offering flexible payment terms like BNPL can be a lifesaver for your suppliers' cash flow. It instantly makes you a preferred customer and can even help you negotiate better terms and pricing down the line.

This is all part of a much bigger movement. The global payment processing market was on track to hit a staggering $173.38 billion in 2025, which tells you everything you need to know about the scale of this change. We're seeing new options gain ground incredibly fast. For example, 33% of U.S. consumers used BNPL in 2025, and over 20,000 companies started accepting Bitcoin. This shows a huge shift toward accepting alternative payments. You can dig into more of these payment solution statistics to see the full picture.

Embracing this evolution isn't just about keeping up with the times. It's about setting the pace, future-proofing your operations, and building a financial ecosystem that's as agile and ambitious as your business.

Fortifying Your Payments Against Fraud

As you get better and faster at processing invoice payments, you also paint a bigger target on your back for fraudsters. Building a strong defense isn't about being paranoid; it's about being smart and proactive. The threats out there are very real, but trust me, the tools and strategies we have to shut them down are more powerful than ever.

The most common scams are often the simplest. One of the most dangerous ones I see is Business Email Compromise (BEC). This is a sneaky one. A fraudster will impersonate a supplier you trust—or even your own CEO—and send a perfectly normal-looking email with an invoice. The only change? The bank account details are theirs, not your supplier's. It's subtle, but it's devastatingly effective.

Building Your Digital Fortress

Protecting your company’s money demands a layered defense. You can't just rely on one single tactic and hope for the best. The real solution is to build a system where multiple security checks work together, creating a seriously tough barrier against anyone trying to make an unauthorized payment.

Here are a few high-impact measures you can put in place right now:

- Multi-Factor Authentication (MFA) for Approvals: This is non-negotiable. Make it mandatory for anyone approving a payment to verify their identity through a second method, like a code sent to their phone. This one step can stop a compromised email account from being used to approve a bogus payment cold.

- Virtual Cards for High-Value Payments: Instead of giving out your main bank account details, generate a single-use virtual card for those large or one-off payments. These cards can be locked to a specific amount and vendor, which makes them completely useless if they get stolen.

- AI-Powered Anomaly Detection: The best payment platforms use AI to learn your company's typical spending habits. The system can then automatically flag an invoice that looks out of place—maybe a payment to a new bank account for a vendor you've worked with for years, or an amount that’s way off from previous invoices.

The goal is to create just enough positive friction to verify legitimacy without grinding your entire workflow to a halt. A two-second verification step is a small price to pay to prevent a five-figure mistake.

Ultimately, even with the best technology in the world, your people are your final line of defense. Train your team to be healthily skeptical of any sudden changes to payment information. A simple phone call to your supplier using a number you already have on file—never the one from the suspicious email—is all it takes to confirm if a change request is real.

And if a fraudulent transaction does slip through, digging into the reasons for a payment failure can give you some incredible insights for making your defenses even stronger. A strong security culture isn't just a policy; it's your greatest asset.

Got Questions About Invoice Processing? We've Got Answers.

Making the leap to a modern, automated financial workflow is a big move, and it’s smart to have questions. This is a game-changing step for your business, and getting clear on the details is the first step toward success. Let’s tackle some of the most common questions that pop up for business owners and finance pros on this journey.

Think of this as your quick-start guide to navigating the transition with total confidence.

What’s the Real Cost to Process a Single Invoice?

The difference between the old way and the new way is genuinely eye-opening. When you do everything by hand—think data entry, printing, stuffing envelopes, postage, and fixing the inevitable human errors—a single invoice can easily run you more than $15. It's a slow, costly process that bleeds your budget one paper cut at a time.

Now, let's flip the script. An automated invoice payment processing system can obliterate that cost, often slashing it by as much as 80%. Suddenly, that $15 invoice costs just a few dollars to handle. The savings aren't just about cutting out manual labor; you're also capturing more early payment discounts, eliminating costly duplicate payments, and giving your team back their most valuable asset: time.

The ultimate win isn't just about the money you save on each invoice. It's about freeing your team from the grind of administrative tasks so they can focus on work that actually drives the business forward.

How Do I Get My Team on Board with Ditching Paper?

Look, change isn't always easy. But the secret to getting everyone excited is to frame the switch around the real-world benefits for them. You’re not just rolling out new software; you’re giving everyone a serious upgrade to their workday.

- For your finance pros: This means no more mind-numbing data entry or endlessly chasing approvals. It frees them up for the work they actually enjoy, like analyzing financials, forecasting cash flow, and shaping business strategy.

- For leadership: Show them the numbers. Build a rock-solid business case that highlights the direct cost savings, the massive improvement in financial visibility, and the huge reduction in risks like fraud and payment errors.

- For your vendors: Let them know this new system means faster, more reliable payments and totally transparent communication. When your suppliers are happy, they become even better partners.

A fantastic way to build momentum is to start small. Run a pilot program with a few of your most trusted suppliers. Once people see the system in action and experience the benefits firsthand, you'll have champions for the change across the entire company.

What Are the Very First Steps to Automating Our Invoices?

Getting started is probably more straightforward than you imagine. It all begins with a clear-eyed look at where you are today.

First up, map your current process from start to finish. Seriously, document every single step, from the moment an invoice hits someone's desk (or inbox) to the second it's paid and filed away. Get brutally honest about the bottlenecks and friction points. Is it the approval chase? The manual keying of data?

Next, get crystal clear on your goals. What's the number one outcome you're aiming for? Is it purely about cutting costs? Or is it speeding up payments to improve cash flow? Maybe it's gaining better insight into company spending.

Once you have your process map and a sharp set of goals, you're ready to start exploring solutions that truly fit your company's needs, budget, and vision for the future. The non-negotiable? Find a platform that plays nicely with the accounting software you already use. That smooth integration is the key to a successful, headache-free transition.

Ready to stop chasing payments and start growing your business? Let JustPayUp automate your invoice reminders so you can get paid on time, every time. Discover how JustPayUp can transform your cash flow today.

Article created using Outrank