Let’s be honest—chasing down late payments is more than just an annoyance. It’s a silent killer of momentum and a massive drain on your business’s potential. Getting paid what you’re owed comes down to a smart, proactive system built on clear communication, a consistent follow-up schedule, and knowing exactly when to kick things up a notch to protect your cash flow. This isn’t about being aggressive; it’s about valuing the work you do and securing the fuel your business needs to grow.

The True Cost of Unpaid Invoices

Every single overdue invoice is more than a line item on a spreadsheet. It’s a story of a project you can’t start, a growth opportunity you have to pass up, and the personal stress that keeps you up at night worrying about financial stability. Just thinking about how to collect unpaid invoices can feel overwhelming, but shifting your mindset is the first, most crucial step toward regaining control.

This isn’t about confrontation. It’s about business self-respect. You provided a valuable service or delivered a fantastic product, and you’ve earned the right to be paid for it. Reclaiming what’s yours is a powerful way to reinforce that your time, your skill, and your effort matter.

Beyond the Balance Sheet

The damage from late payments seeps into every corner of your operation. It creates a cash flow chokehold that can completely stall your momentum and back you into making tough decisions you shouldn’t have to make.

Think about all the hidden costs piling up:

- Lost Opportunities: That money stuck in receivables could be your next big marketing campaign, a much-needed equipment upgrade, or the salary for a key new hire.

- Strained Resources: The hours you or your team spend chasing invoices are hours stolen from innovation, customer service, and actual revenue-generating work.

- Increased Stress: The mental load of worrying about making payroll or paying your own suppliers is exhausting and takes a real toll on you as a leader.

The financial and operational fallout is shocking. UK SMEs lose an average of £22,000 per year to late payments, which adds up to a staggering 56 million hours of wasted time and productivity. This cash flow crisis is so severe it forces around 50,000 UK businesses to shut their doors for good each year. You can dive deeper into the data on the impact of unpaid invoices to see just how vital a solid collection strategy really is.

Your collections process is a direct reflection of how much you value your own business. A firm, fair, and consistent approach doesn’t just get you paid—it builds a reputation for professionalism that clients will respect.

By putting a structured system in place, you’re not just chasing money. You’re building a more resilient, more profitable, and far less stressful business. It’s time to start protecting your bottom line and your peace of mind.

Laying the Groundwork for On-Time Payments

The secret to collecting unpaid invoices? It’s creating a system where they rarely become overdue in the first place. This work begins long before you ever send a bill. It’s all about building a foundation of clarity and professionalism from your very first conversation with a client, making payment a natural part of your partnership, not an awkward afterthought.

Think of your invoicing as an extension of your brand. A vague, confusing, or sloppy invoice doesn’t just look bad—it practically invites delays. On the other hand, a clear, professional invoice sends a powerful message: you’re organized, you mean business, and you expect to be paid promptly.

Design Invoices That Get You Paid

Your invoice should be a crystal-clear call to action. The last thing you want is for a client to have to search for the information they need to pay you. Every single detail should be designed to remove friction and eliminate any potential excuse for a delay.

- Make the Due Date Unmissable: Don’t bury it. Use a large font, bold text, or even a colored box to make it pop. Vague terms like “Due Upon Receipt” are easily misinterpreted; a concrete date like “Due by January 31, 2025” leaves no room for doubt.

- Show Them How to Pay: Clearly list every payment method you accept. For online payments, include a direct link. For bank transfers, provide all the necessary details. If you accept checks, give them the correct mailing address. Make it effortless.

- Itemize Everything: Break down exactly what services or products the client is paying for. This transparency preempts questions and disputes that can stall the payment process for weeks.

Set Clear Expectations from Day One

Your client onboarding process is the perfect time to talk about payment terms. Don’t shy away from this conversation or rush through it. Frame it as a standard, essential step in kicking off a successful project together.

Establishing clear payment expectations upfront isn’t about being pushy; it’s about showing respect for your own work and for the client’s role in the partnership. It sets a professional tone that prevents so many headaches down the road.

This is your moment to clearly outline your payment schedule, what methods you accept, and what happens if an invoice becomes overdue. The key is to get all of this documented in your contract or service agreement. A great way to understand how these clauses work is to review standard business terms and conditions.

Having this agreement in writing gives you a solid reference point if any issues pop up, turning what could be a messy dispute into a simple contract review. By making these practices part of your process, you create a smooth payment experience that encourages clients to pay on time, securing your cash flow and strengthening your business.

Your Proven Communication Sequence for Overdue Invoices

Let’s be honest: chasing down overdue invoices is probably the least favorite part of your job. But having a smart, repeatable communication plan can turn this frustrating task into a manageable process. This isn’t about being aggressive; it’s about being professional, persistent, and crystal clear.

The whole idea is to start with a gentle nudge, assuming the best, and only ramp up the urgency when you absolutely have to. This methodical approach protects your cash flow and, just as importantly, your client relationships.

You might be surprised to learn that most late payments aren’t malicious. In fact, nearly a quarter of them happen simply because clients forget to pay. With a staggering 81% of businesses reporting late payments on at least a quarter of their monthly invoices, a solid reminder system is a must-have. If you want to dive deeper, you can explore more accounts receivable statistics to see just how common this headache is.

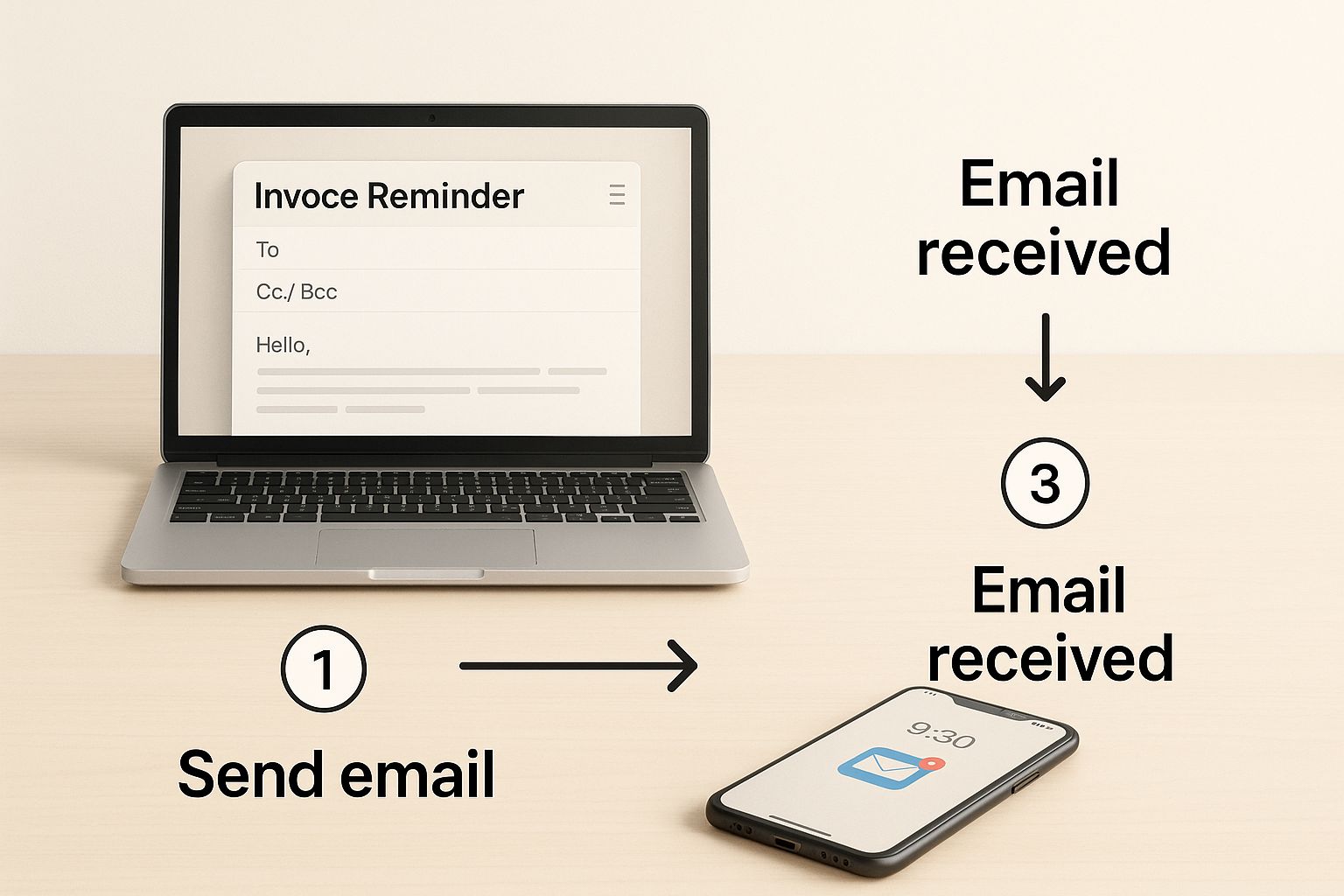

This infographic breaks down a modern, effective communication flow that mixes smart automation with a personal touch.

The real magic here is using multiple channels—email, app notifications, and even a direct phone call. It creates a polite but persistent presence that’s pretty hard to ignore.

To make this crystal clear, here’s a timeline I’ve seen work wonders for countless businesses. It balances automation with the right human touch at just the right moments.

Invoice Reminder Cadence and Communication Strategy

| Timing | Channel | Tone | Action |

|---|---|---|---|

| 7 Days Before Due Date | Automated Email | Friendly & Proactive | Send a “friendly reminder” with the invoice attached and a direct payment link. This is a customer service touchpoint, not a demand. |

| On Due Date | Automated Email | Polite & Professional | A simple, direct message stating the invoice is due today. Assume it was just overlooked. |

| 7 Days Past Due | Firm but Professional | Shift the language from a “reminder” to a “follow-up on an overdue invoice.” Ask if they’ve received it and if there’s an issue. | |

| 14 Days Past Due | Phone Call & Email | Direct & Solution-Oriented | Make a personal phone call to get a direct commitment for payment. Follow up immediately with an email summarizing the conversation. |

| 30 Days Past Due | Email or Letter | Serious & Consequence-Aware | Formally state that the account is 30 days overdue and mention potential late fees or service interruptions as outlined in your contract. |

| 60-90 Days Past Due | Formal Letter / Call | Final & Decisive | Issue a final demand for payment. This is the last step before considering a collections agency or legal action. |

This structured cadence removes the guesswork and emotion from the process, ensuring you stay professional while still taking firm action to get paid.

The Gentle Nudge: A Week Before It’s Due

The best way to deal with a late payment is to stop it from ever happening. A friendly, automated email sent a week before the due date is my go-to first step. Seriously, it works. Think of it not as a collection attempt, but as great customer service.

You’re just giving your client a helpful heads-up, making their life easier by putting the invoice on their radar with plenty of time to get it processed.

- Subject Line Idea: Friendly Reminder: Your Invoice [#12345] is Due Next Week

- What to Include: Keep it light. Make sure the invoice number, amount, and due date are clear. Most importantly, include a direct payment link so they can settle up in just a few clicks.

This one proactive step shows you’re organized and sets a positive, professional tone right from the start.

The First Official Reminder: On the Due Date

Once the due date hits, it’s time for the first official reminder. The tone should still be friendly and polite—always assume it was a simple oversight. This is the perfect place to let automation do the work. A platform like JustPayUp can send this out for you, so it’s always on time.

Your goal at this stage is to be helpful, not confrontational. A calm, professional tone maintains goodwill while clearly restating the facts of the invoice.

Always re-attach the original invoice to save them the hassle of digging through their inbox. A short, to-the-point message reminding them of the amount and date is all you need, along with that all-important payment link.

The Follow-Up: One Week Past Due

Okay, so a week has passed and the invoice is still unpaid. It’s time to shift your tone slightly. Still professional, of course, but a bit more direct. Your message now becomes less of a reminder and more of an active inquiry.

Email Subject Idea: Follow-up on Overdue Invoice [#12345]

At this stage, it’s completely fair to ask them to confirm they’ve received the invoice and if there’s anything holding up the payment. This little nudge often gets a response and can uncover legitimate issues, like the invoice being sent to the wrong person or a question they had about the work.

The Personal Touch: A Phone Call at Two Weeks Late

If your emails have been met with radio silence for two weeks, it’s time to pick up the phone. It’s incredibly easy to ignore an email. A real conversation? Not so much. A phone call cuts through the digital noise and adds a human element that text just can’t match.

When you call, be polite but firm. Introduce yourself, your company, and reference the specific invoice number. Your goal is simple: get a straight answer and, if possible, a concrete commitment on when you can expect payment.

Right after you hang up, send a follow-up email summarizing your conversation and the payment date you both agreed on. This creates a paper trail and holds everyone accountable.

When gentle reminders and friendly phone calls aren’t getting the job done, it’s time to change gears. If you’ve been met with silence, don’t take it personally, but do take it seriously. The time for giving the benefit of the doubt is over. Now, your goal is to show you’re committed to collecting what you’re owed, shifting from simple reminders to decisive action.

This isn’t about being aggressive; it’s about being firm and protecting the business you’ve worked so hard to build. Each step from here on out sends a powerful message about your professionalism and resolve.

Hit Pause on All Work

One of the most effective ways to get a client’s attention is to stop working. It can feel like a tough move, especially with a client you like, but continuing to deliver services while invoices are outstanding is just bad business. You’re essentially giving them an interest-free loan at your own expense.

Let them know your decision clearly and professionally in writing. A short, direct email usually does the trick: “Hi [Client Name], we’ve had to pause all work on [Project Name] until invoice [#12345] is settled. We’re ready and eager to jump back in as soon as the balance is cleared.” This simple action often creates the urgency that was missing before.

Offer a Path Forward with a Payment Plan

Sometimes, a client’s radio silence isn’t a sign of avoidance but of genuine financial difficulty. Offering a structured payment plan can be a brilliant way to recover your funds while showing a bit of compassion. It demonstrates your flexibility but also—and this is key—it formalizes their commitment to pay.

If you go this route, be crystal clear about the terms:

- Break it down: Define the exact installment amounts (e.g., three monthly payments of $500).

- Set the dates: Assign a firm, non-negotiable due date for each payment.

- Put it in writing: Lock in the agreement with an email or a simple contract that both of you sign off on.

Automating these payments can make the process seamless for everyone. It also helps to be prepared for hiccups. Understanding the common reasons for a payment failed message can help you and your client troubleshoot if an installment doesn’t go through as planned.

A final demand letter isn’t just another email. It’s official documentation proving you made a final, formal attempt to resolve the debt. This piece of paper becomes critical evidence if you have to take things further.

Send the Final Demand Letter

When a client ignores your offers and remains unresponsive, the final demand letter is your next move. This isn’t just another reminder; it’s a formal communication that signals the end of your goodwill. Send it via a trackable method, like certified mail, so you have proof it was delivered.

Keep the tone firm and professional. Your letter must include all the critical details: the original invoice number, the total amount owed, a brief history of your attempts to collect, and a final deadline. Be explicit about the consequences of not paying, whether that means involving a collection agency or taking legal action.

Bringing in the Pros: Collections and Legal Action

If you’ve exhausted all your options, it’s time to let the experts take over. A collection agency or a small claims court lawsuit are your last resorts.

- Collection Agencies: These agencies typically work on contingency, meaning they take a cut of whatever they successfully recover. It’s a hands-off approach for you, but be prepared for their fees, which often run from 20% to 50% of the debt.

- Small Claims Court: For smaller invoices (usually under $7,000, but this varies by state), you can represent yourself in court. It’s a more direct process that can result in a legally binding judgment against the client.

Before you take this step, do a quick cost-benefit analysis. Is the amount owed worth the fees or the time you’ll spend in court? For significant amounts, the answer is almost always yes. This is the final step in reclaiming what you’ve rightfully earned.

Putting Your Collections on Autopilot

Let’s be honest. Manually tracking due dates, writing reminder emails, and making those awkward follow-up calls is a soul-crushing time suck. If you want to get your time back, slash your stress levels, and actually get paid faster, automating your collections is the single biggest move you can make. It’s about building a machine that gets you paid while you’re busy doing the work you love.

Think about it. Instead of you having to flag your calendar for that 7-day past-due email, a platform like JustPayUp can handle the entire chase for you. The system sends the right message at the right time, every single time. That kind of consistency is almost impossible to pull off on your own when you’re juggling a dozen other priorities.

This isn’t just a “you” problem, either. Late payments are a global headache. In Australia, a staggering 37% of B2B invoices are paid on time, and it’s not much better in the US, where about half are overdue. You can dig into more of these eye-opening late invoice statistics yourself. It’s a systemic issue, and frankly, it’s one that technology is built to solve.

How Automation Actually Protects Your Client Relationships

Here’s something most people don’t realize: automation is one of the best things you can do for your client relationships. How? It takes you out of the equation.

The system sends the reminders, not you personally. This instantly removes the emotional baggage and potential awkwardness from the follow-up. Suddenly, you’re not the one nagging them for money. You get to maintain your role as their trusted expert and partner, not a debt collector.

The messages are polite, professional, and persistent. They act as a neutral party, simply enforcing the payment terms you both agreed to.

Automation transforms your collections process from a reactive, emotional chore into a proactive, systematic function of your business. It’s the key to maintaining healthy cash flow without sacrificing the goodwill you’ve worked so hard to build.

A quick glance at a dashboard, like this one from JustPayUp, gives you a bird’s-eye view of every invoice. Nothing falls through the cracks, and you always know exactly where your money is.

Set It Up Once, Get Paid Forever

Getting started is surprisingly simple. You can take the exact communication plan we’ve just walked through and build it into an automated sequence. The big difference? It runs itself.

- Build Your Follow-Up Cadence: Set up reminders to go out a week before the due date, on the day it’s due, and at whatever intervals you choose afterward (7, 14, 30 days past due is a common one).

- Keep Your Voice: Use templates, but tweak them so they sound like you. You can be friendly and helpful while still being firm and crystal clear about what’s needed.

- See Everything: A good system gives you full transparency. You’ll know exactly when an invoice was sent, when your client viewed it, and when it’s been paid.

And the best part? The moment that payment hits, the system automatically stops the reminders. It can even fire off a thank you note. Our guide on sending a professional payment confirmation has some great tips for crafting that final message. It’s a small touch that reinforces your professionalism and ends everything on a high note, paving the way for your next project together.

Dealing with the Tricky Parts of Invoice Collection

Even with the best system in place, you’re going to hit some bumps in the road. It’s inevitable. But knowing how to handle these common challenges is what really sets you apart. It’s all about staying cool under pressure and having a game plan before you ever need it.

Let’s walk through some of the most common hurdles you’ll face. Think of this as your playbook for those moments that make you think, “Okay, what now?”

What to Do When a Client Says They Never Got the Invoice

Ah, the classic “I never got it” line. It’s often just a delay tactic, but your response needs to be swift and professional. The second a client tells you they never received the invoice, don’t just promise to send it again later. Do it immediately.

Get on the phone or reply to their email right then and there. Attach the invoice and hit send while you’re still communicating with them. Ask for a quick confirmation that they’ve received it this time. This simple act politely takes away their excuse and puts the responsibility right back on them. It’s also the perfect moment to verify their contact information to make sure this doesn’t become a recurring theme.

Should You Charge Late Fees on Unpaid Invoices?

Absolutely, but you have to do it the right way. Late fees can be a powerful motivator for on-time payment, but they can’t come as a surprise. Your policy on late fees must be crystal clear in your original contract or service agreement and spelled out on every single invoice. When it comes to fees, transparency is everything.

I’ve found it’s always a good idea to send one last warning before a fee kicks in. A quick note saying, “Just a heads-up, our late fee policy will apply to this invoice in three days,” often does the trick. It shows you mean business but still gives them a chance to do the right thing. And always, always double-check your local laws—some places have caps on how much you can charge.

How to Collect a Really Old Invoice

When an invoice is several months past due, the time for gentle reminders has passed. It’s time to be more direct and firm. I always start with a phone call to try and understand the root of the problem. If they’re struggling with legitimate cash flow issues, offering a structured payment plan can be a great way to get the ball rolling.

But if they’re unresponsive or just unwilling to work with you, it’s time to escalate. The next step is a formal demand letter. This isn’t just another email; it’s an official communication that clearly outlines the debt and states your intent to take further action if it’s not paid by a specific, firm deadline. It’s the move that shows you are serious about getting paid what you’re owed.

Ready to stop chasing payments and start getting paid on time? JustPayUp automates your entire invoice follow-up process, so you can focus on your business. Upload your invoices and let our system do the work.